Finance professionals and business executives rely on data modelling tools such as Excel to project financial performance and make financial decisions.

Financial modelling can be used for raising capital, entering into new market segments, increasing market share and valuing the company or assets.

If you're an analyst working with private equity investors, commercial and investment bankers, accountants and other professionals, then here are 10 types of financial models you need to know to get the data and insights necessary for future planning.

Financial modelling relies on inputs from a company's financial and operational history. Financial models provide insight and data for future planning, income forecasting and expense projecting.

Other uses include:

Businesses can create dynamic models using tools such as Excel in which users can link important financial documents such as income statements, balance sheets, complex debt obligations and more.

There are 10 types of financial models that we're going to cover. These can be divided between internal models, and external models.

By pairing these models with a baseline corporate finance understanding and efficient templates, you can model your business's financial needs and plan for the future.

Most financial models provide insight valuable to a company's executive team for internal purposes. Such purposes include budgetary planning and business and market expansion or consolidation.

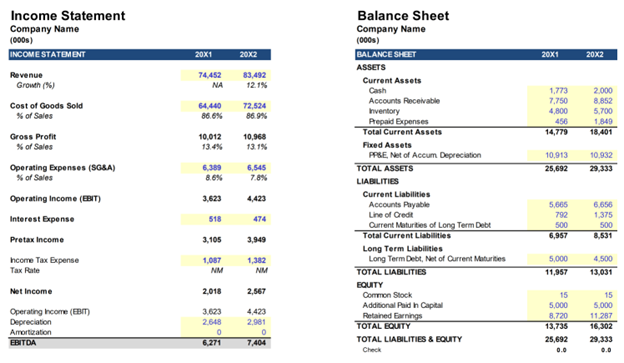

One of the standard financial models is the three-statement model, which includes:

Financial analysts can use the three-statement model to project a business's performance over a set period. The model incorporates certain assumptions about operations, such as revenue growth rate, operating margin and net profit margin.

Source: A Simple Model

Once you've grasped the three-statement model, you can build more complex financial planning diagrams that rely on the linkages created among the three statements above.

The discounted cash flow (DCF) model accounts for the time-value of money by discounting projected free cash flows to the present date. These free cash flows may be levered or unlevered.

In both cases, the DCF illustrates a company's (1) enterprise value and (2) equity value. This model demonstrates whether the company's current market value is underpriced or overpriced.

The sum of the parts model combines multiple DCF models into one projection. Unlike investments with a tangible value, the sum of the parts model includes assets that don't neatly fit into a DCF analysis. Consider marketable securities, for example, which are valued based on the market.

Like the DCF model, you can use a sum of the parts analysis to derive the business's net asset value (NAV). For instance, you add the value of Business Unit 1 to Business Unit 2 and Investments 3. You then subtract Liabilities 4 to determine the NAV.

As compared with the sum of the parts model, the consolidation model sums up each business unit. This creates a single model consolidating each business unit.

A budget model is simple but plays a vital role in your company's business planning process. Depending on your financial calendar, you may include either monthly or quarterly figures. Like the three-statement model, the budget model also incorporates the income statement and enables financial analysts to plan for future years.

The forecasting model enables financial planning and analysis professionals to compare future projections with present budget estimations. You may combine the forecast with the budget in one workbook or maintain separate models.

While Excel offers complex data modelling features, some models work like simple calculators. The option pricing model is one example, including the binomial tree and the Black-Scholes model. Both rely on mathematical formulas instead of user-defined subjective criteria.

Financial analysts can employ the following models to make business decisions affecting other corporations. For example, these models help explain whether combining with another business entity is a prudent financial decision.

Where one of the most common financial models is the three-statement model, the leveraged buyout model is more complex and builds on the business's projected performance. The leveraged buyout (LBO) model is useful for private equity and investment banking analysts.

The nature of the purchase requires complex debt modelling. For example, you must account for cash flow waterfalls and circular references created by the multi-tiered financing structure.

Another model valuable investors and corporate institutions is the initial public offering (IPO) model. The IPO model requires analysts to evaluate their business's potential value with comparable companies against an underlying assumption about what potential investors would pay for the business's potential stock.

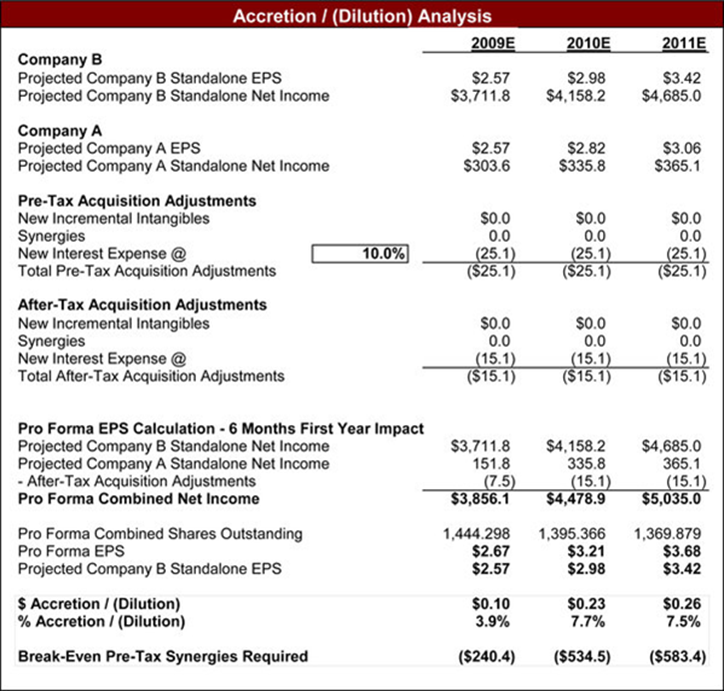

The merger model is a category including the accretion and dilution of a merger or acquisition.

Source: Street of Walls

Each company may use one Excel tab, while the proposed merged entity would be on its own third tab. Corporate development and investment banking professionals may increase the complexity of the model depending on the nature of the businesses involved.

Grow Your Career With Access to Free CPE/CPD Courses & Certifications

Register Today